Enhancing Profitability, Capital Efficiency, and Financial Stability to Build a Foundation for Growth

- Kaiju Yamaguchi

- Director,

Senior Executive Corporate Officer,

Chief Financial Officer (CFO),

PHC Holdings Corporation

1. Review of Fiscal Year 2024

Reflecting on fiscal year 2024, PHC Group’s most notable achievement was recording the highest revenue and profit since our listing on the Tokyo Stock Exchange. Revenue increased by 2.2% year-on-year to JPY 361.6 billion, operating profit rose substantially to JPY 22.6 billion, and profit attributable to owners of parent reached JPY 10.5 billion. This marked the first time the company achieved net profit since our listing and represented a pivotal moment of strong financial results for PHC Group. Looking at each segment, starting with Diabetes Management, the BGM business remains our primary profit driver, though it continues to experience declines in revenue and profit due to ongoing market shrinkage and the termination of a sales collaboration in the U.S. as previously reported. In our Value Creation Plan 2027 (VCP), we have outlined measures to narrow the revenue decline. Encouragingly, the revenue decline in fiscal year 2024 lessened compared to the previous year, setting us off on a strong start in achieving our goals outlined in the VCP. In the CGM business, in the third quarter we launched a new product, Eversense® 365, the industry’s only one-year CGM device. This product has driven higher sales compared to its predecessor. While overall segment revenue declined by 2.9% year-on-year to JPY 98.7 billion, there are encouraging signs of progress.

In Healthcare Solutions, the healthcare IT solutions business in particular benefited in fiscal year 2024 from Japanese government-led medical digital transformation (DX) policies, which boosted demand for electronic prescription software. Furthermore, the effects of M&A activity carried out in fiscal year 2023 positively impacted the business. The overall segment recorded a 6.7% year-on-year increase in revenue, reaching JPY 128.3 billion.

As for Diagnostics & Life Sciences, which we identified as a key focus domain in the VCP, revenue grew by 1.0% year-on-year to JPY 130.9 billion. Despite weaker demand for equipment in fiscal year 2024, sales of consumables in the pathology business were robust.

In terms of profit, operating profit grew significantly, and we ended fiscal year 2024 with a positive net profit. Over the previous three years, impairment losses had significantly affected our profitability, however fiscal year 2024 was free of impairment losses, allowing us to achieve profitability through earnings generated by our business operations. We view the fiscal year 2024 results as a solid start toward achieving the goals of the VCP, particularly in stabilizing our performance and building a foundation for consistent profit generation.

At the same time, we recognize that PHC Group has not yet achieved sufficient recognition from shareholders and investors as an organization with stable performance and steady growth potential for the future. In fiscal year 2025, it will remain crucial to demonstrate quarterly progress that aligns with our forecasts and build a solid track record of achievements to gain the trust of the capital markets. As a publicly listed company, we must strive to become a preferred choice over other listed companies, deliver returns, and achieve sustainable growth. I also consider it one of my key responsibilities to ensure that all of us within our organization fully recognize these expectations for a listed company.

2. Current Assessment of Our Stock Price

Our stock price remains below a price-to-book ratio (PBR) of 1. We believe that past underperformance against earnings forecasts and net losses have affected investor trust in our earnings forecast or expectations for growth. Consequently, the cost of equity capital and expected returns reflected in the market are assumed to be higher than the theoretical values derived from the Capital Asset Pricing Model (CAPM). We believe this disparity contributes to our lower valuation multiples compared to other companies. To close the gap between theoretical values and expected returns, we will continue striving to achieve our forecasts in fiscal year 2025 while focusing during this VCP period on improving profitability, capital efficiency, and financial stability. By doing so, we aim to build trust in our forecasts and establish a solid foundation for growth.

In previous VCPs, the emphasis was on making investments for growth. However, growth is only possible if those investments generate returns that exceed the cost of capital. In the current VCP, we see it as crucial to enhance our business foundation by reviewing past investments and improving profitability and capital efficiency. This approach will enable us to establish a structure capable of consistently generating returns above the cost of capital. Through Phase 1 of the current VCP, we intend to build a solid business foundation. This will enable us to drive growth through strategic investments in Phase 2, beginning in 2028.

3. Profitability Improvement

Implement a group-wide structural reform to strengthen the profit base, aiming to further enhance cash generation capabilities and strengthen the financial structure.

|

Impact of Measures*

(Improvement Amount in Fiscal Year 2027 Compared to Fiscal Year 2024) |

| Profitability Improvement |

Cost Optimization |

Cost Optimization Including Process Improvement and Supply Chain Optimization |

+JPY 8-12 Billion |

| Optimization of Locations and Organizations |

Optimization of Personnel Numbers Through the Consolidation of Bases and Organizations |

| Capital Efficiency Improvement |

Investment Efficiency |

Prioritization Based on Investment Efficiency |

+JPY 2-3 Billion |

| Sale of Non-business Assets |

Sale of Non-strategic Minority Shareholdings and Idle Assets |

* The assumed exchange rates are 1 USD = 140 JPY and 1 EUR = 155 JPY.

I would like to elaborate on the measures outlined in the VCP to close the gap between theoretical values and expected returns, as well as our efforts to improve profitability, capital efficiency, and financial stability.

To improve profitability, we are advancing initiatives focusing on cost optimization and optimization of locations and organizations. Investors often ask how this approach differs from past structural reforms. The key distinction lies in adopting a cross-group, horizontal approach to reform. Historically, due to our background in acquiring multiple businesses, individual business units have tended to operate with their own locations and organizational structures, executing initiatives independently. We aim to standardize these operations across all group companies to improve efficiency and reduce costs.

One specific example is our procurement function. Previously, each business unit managed its own procurement activities. However, we are now establishing a new global organization that operates across PHC Group to improve cost efficiency by leveraging economies of scale in procurement. Additionally, we are reassessing the organizations and locations within each business from a cross-domain perspective. For instance, in April 2025, we integrated the sales organizations in the Diagnostics & Life Sciences domain in Japan. This integration is designed to lower costs by sharing infrastructure while boosting sales efficiency through cross-selling. We will continue optimizing our organizations and locations in the future.

As part of the standardization and optimization process, we have adjusted reporting lines and established a unified global organization to address challenges as a group-wide project. We believe that this approach will continue to enhance collaboration within PHC Group. Furthermore, by clearly communicating internally that we are working on improvement efforts across all group companies, we believe many employees will view these initiatives positively. Our goal is to implement these initiatives throughout PHC Group while fostering a strong sense of positive engagement among our employees.

4. Capital Efficiency Improvement

Based on ROIC (return on invested capital) and market growth potential,

we have positioned each business as follows.

To improve capital efficiency, we have been advancing the sale of non-operating assets since fiscal year 2024. This includes the sale of land previously used for manufacturing sites and the divestment of other companies’ securities. Going forward, we will continue to sell non-operating assets and allocate the proceeds toward investments or enhancing our financial foundation.

In addition, starting with the current VCP, we are introducing group-wide ROIC management. While we have previously focused on profit and loss metrics such as operating profit and EBITDA, we will now also emphasize cash flow. By incorporating Balance Sheet perspectives—such as reducing inventory to decrease working capital and utilizing fixed assets more effectively—we aim to enhance capital efficiency. In terms of business portfolio management, we have also refined the positioning of each business by evaluating it based on ROIC and growth potential.

The “Growth Business,” indicated as (1) in the diagram, represents the segments driving PHC Group’s growth. As for the Biomedical business (PHCbi), we anticipate stable market growth within its existing regions. This business offers high-quality products globally, including ultra-low temperature freezers with industry-leading energy efficiency powered by precise temperature control technology. We expect its steady growth to continue in the future. We also foresee significant growth and substantial market potential in the field of cell therapy. In fiscal year 2024, we introduced the LiCellMo™ Live Cell Metabolic Analyzer, which analyzes cell culture conditions in laboratory research through real-time measurement of cell metabolism. Additionally, in fiscal year 2025 we plan to launch another innovative product, the cell expansion system LiCellGrow™, which is currently under development. With this product, we will seek to enable efficient cell culture while maintaining optimal culture conditions. As these new and in-development cell therapy products also involve consumables sales, we anticipate an increase in recurring revenue, further improving business stability and profitability.

The “Nurture Business,” marked as (2) in the diagram, is positioned as a business with currently modest ROIC but a growing market. Our strategy is to increase sales while gradually improving profit margins.

In the Diabetes Management CGM business last year, we launched Eversense® 365, the industry’s only one-year CGM device, and we are focusing on expanding its sales this fiscal year*1.

- *1

On September 4, 2025, PHC Holdings Corporation and its subsidiary Ascensia Diabetes Care announced that Ascensia has signed a memorandum of understanding to transfer the commercial operations for Eversense® Continuous Glucose Monitoring (CGM) systems to Eversense maker Senseonics Holdings, Inc. The companies are targeting to unite Eversense R&D, manufacturing, and commercial activities within Senseonics beginning January 1, 2026, subject to a definitive agreement.

On September 4, 2025, PHC Holdings Corporation and its subsidiary Ascensia Diabetes Care announced that Ascensia has signed a memorandum of understanding to transfer the commercial operations for Eversense® Continuous Glucose Monitoring (CGM) systems to Eversense maker Senseonics Holdings, Inc. The companies are targeting to unite Eversense R&D, manufacturing, and commercial activities within Senseonics beginning January 1, 2026, subject to a definitive agreement.

https://ssl4.eir-parts.net/doc/6523/tdnet/2684179/00.pdf

In the Pathology business (Epredia), we introduced a new product targeting the growing digital pathology market in Spring 2025. The pathology market is expanding at a mid-single-digit rate, and we plan to drive overall sales by boosting existing product sales while launching new products in higher-growth areas. Furthermore, we operate four global manufacturing sites and are working to enhance their productivity by leveraging expertise from other business units. Through these efforts, we aim to improve profitability. The In Vitro Diagnostics (IVD) business underwent a group-wide reorganization in 2023. The Diagnostic Reagents & Instruments business, previously operated under LSI Medience, was merged with PHC Corporation’s OEM-focused IVD business. We aim to maximize the synergies from this integration. Additionally, we have entered into a distribution agreement in the U.S. for the portable immunoanalyzer PATHFAST and are actively working to expand its sales.

The “Foundational Business,” shown as (3) in the diagram, is characterized by its strong cash generation capabilities. While the Diabetes Management BGM business has faced a shrinking market, our sales have declined more than the overall market, partly due to the termination of a sales collaboration in the U.S. as previously reported. A key focus of ours during the VCP period is to reduce the scale of this revenue decline. Stabilizing the North American market is critical to achieving this, and we saw encouraging signs in fiscal year 2024. In fiscal year 2025, we will continue implementing measures to stabilize the North American market. As this is a highly profitable business, narrowing the revenue decline will allow it to continue contributing to PHC Group as a stable cash-generating business.

Our Healthcare IT Solutions business provides electronic medical record (EMR) systems and medical-receipt computers in Japan, generating recurring revenue by providing updates in response to changes in insurance regulations and offering comprehensive support services. Additionally, under the Japanese government’s promotion policy for digital transformation in healthcare, the adoption of systems such as the Online Eligibility Check System and electronic prescriptions has been accelerating. The Japanese government has also set a target of achieving 100% EMR adoption by 2030. This creates substantial business opportunities, and we are committed to capturing this momentum. Building on our core products, which were on-premises systems, we launched a new cloud-based EMR system in April 2025 and expect it to become a flagship product. By expanding sales of this product and establishing a leading position in the cloud market, we believe the business can further enhance its cash generation capabilities.

The “Restructuring Business,” labeled as (4) in the diagram, includes the clinical testing business of LSI Medience and the contract research organization (CRO) business. These two businesses have relatively high fixed cost structures. While considering a wide range of options, including external collaborations and leveraging capital, we are taking proactive steps to improve profitability. This involves reviewing all aspects of both businesses, including cost reductions and price negotiations, as well as efforts to restructure our sales processes. Through these improvement initiatives, we aim to enhance profit margins and contribute to the overall profitability of PHC Group.

Regarding ROIC, we are progressing with its rollout across PHC Group, including the development of management frameworks and processes. While internal responses to its adoption have varied, the introduction of ROIC sets a clear standard to heighten awareness of capital costs, establish a common standard across PHC Group, and assess and improve investment efficiency. Even businesses currently classified as “Nurture Businesses” may be reclassified as "Restructuring Business" if they do not achieve sufficient growth relative to market expansion or if their investment efficiency does not increase quickly enough. Conversely, if a business grows and its investment efficiency exceeds expectations, it may receive additional investment. This system is being implemented across PHC Group. Additionally, focus on working capital has been growing as part of efforts to enhance ROIC. By prioritizing cash flow, increasing focus on the balance sheet, and improving ROIC, we will continue to advance and refine these initiatives within each business.

5. Improving Financial Stability

During the current VCP period, our policy is to prioritize strengthening PHC Group’s financial foundation to establish a system that allows for stable increases in shareholder returns along with business growth in the next VCP.

* The assumed exchange rates are 1 USD = 140 JPY and 1 EUR = 155 JPY.

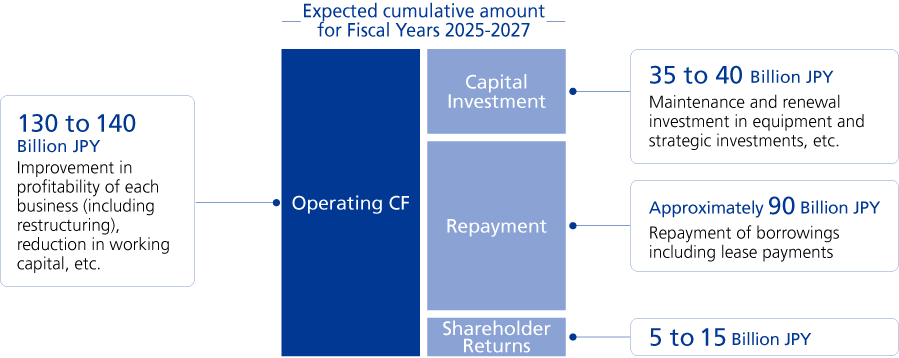

This figure presents capital allocations during the period of the Value Creation Plan 2027, where we are prioritizing the strengthening of our financial structure.

With a high ratio of interest-bearing debt repayments to operating cash flow, and high leverage, we believe we have incorporated financial risk into the cost of capital. To improve this, we will prioritize these repayments during the current VCP period, reduce the cost of capital by stabilizing our financial foundation, build a flexible investment structure, and use that structure to achieve growth in the next VCP.

In terms of shareholder returns, our dividend forecast for the current fiscal year is that same as for last fiscal year. While we aim to keep dividends stable as much as possible, our final decision is based on our basic policy of prioritizing the strength of our financial foundation.

6. Financial Targets

|

Fiscal Year 2027 Targets |

| Profitability |

Revenue growth rate (YoY) |

4-5% |

| Operating profit margin |

8-10% |

| EPS |

Two times fiscal year 2024 or higher |

| Efficiency |

ROE |

10% or more |

| ROIC |

8% or more |

After announcing our financial targets in the current VCP, some investors and analysts commented that the numbers seemed aggressive. This may have been due to the fact that we announced the VCP in November 2024, and the targets might have seemed aggressive compared to fiscal year 2023. However, our operating profit margin of 6.2% in fiscal year 2024 meant that the gap between existing and target numbers was smaller than fiscal year 2023. While we have work to do to achieve our target ROIC of 3.8%, we took the cost of capital into account when setting this target. Despite some challenges, we believe this target is achievable if we properly implement the VCP measures explained above.

7. Conclusion

When I was appointed as CFO in July 2024, I explained my policy of focusing on cash flows. The reason is that focusing on cash flows leads to more attention and improvements in areas like terms of payment, inventory levels, and production. I believe that focusing on cash flows and ROIC will create discipline that leads to increased levels of cash and enhanced corporate value.

Before becoming CFO, I led investor relations for PHC Group, and during my meetings with investors I observed a high sensitivity to risk and uncertainty. From the perspective of those investors, any uncertainty or lack of clarity in a business can lead to an increased cost of capital. Without clarifying important business points, providing easy-to-understand communication around business stability and market growth potential, and increasing trust, investors may lose interest. We have addressed this need for information in our VCP. For instance, we present our business portfolio in four quadrants based on ROIC, and our forecast for a sales decline in the BGM business.

I consider my role as ensuring that everyone in the company knows how the capital market rates us, to set challenges and lead efforts to address them, and to explain progress of those improvements to investors in an easy-to-understand way. I hope to create a virtuous cycle of improvement leading to better business performance, and better business performance leading to higher stock prices.

From our listing on the Tokyo Stock Exchange in 2021 through fiscal year 2023, we experienced losses that have not produced the results we seek for shareholders and investors.

However, after a change of management structure including a new CEO in fiscal year 2024 and the announcement of our VCP last November, we were able to end the year in profit. We will strive to enhance our corporate value going forward by continuing this positive momentum and steadily implementing the measures established in the current VCP. We will do our best to meet and exceed the expectations of our shareholders. Thank you as always for your continued support.